how much taxes does illinois take out of paycheck

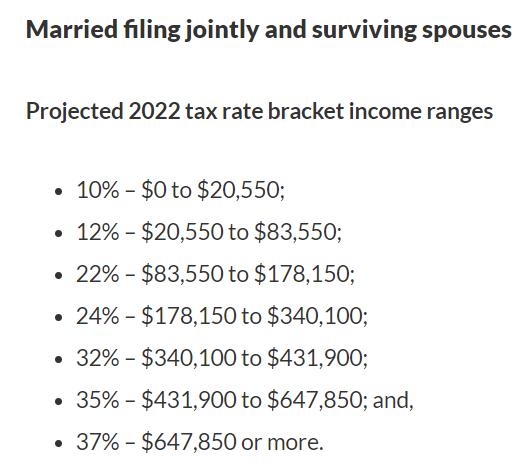

So the tax year 2022 will start from July 01 2021 to June 30 2022. Total income taxes paid.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

What percentage is taken out of paycheck taxes.

. 392 cents per gallon of regular gasoline 467 cents per gallon of diesel. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. This applies to workers over the age of 18.

So the tax year 2022 will start from July 01 2021 to June 30 2022. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

216 average effective rate. Ad Payroll Employment Law for 160 Countries. The wage base is 12960 for 2022 and rates range from 0725 to 7625.

Newly registered businesses must register with IDES within. How much taxes is taken out of a paycheck in Illinois. Illinois Hourly Paycheck Calculator.

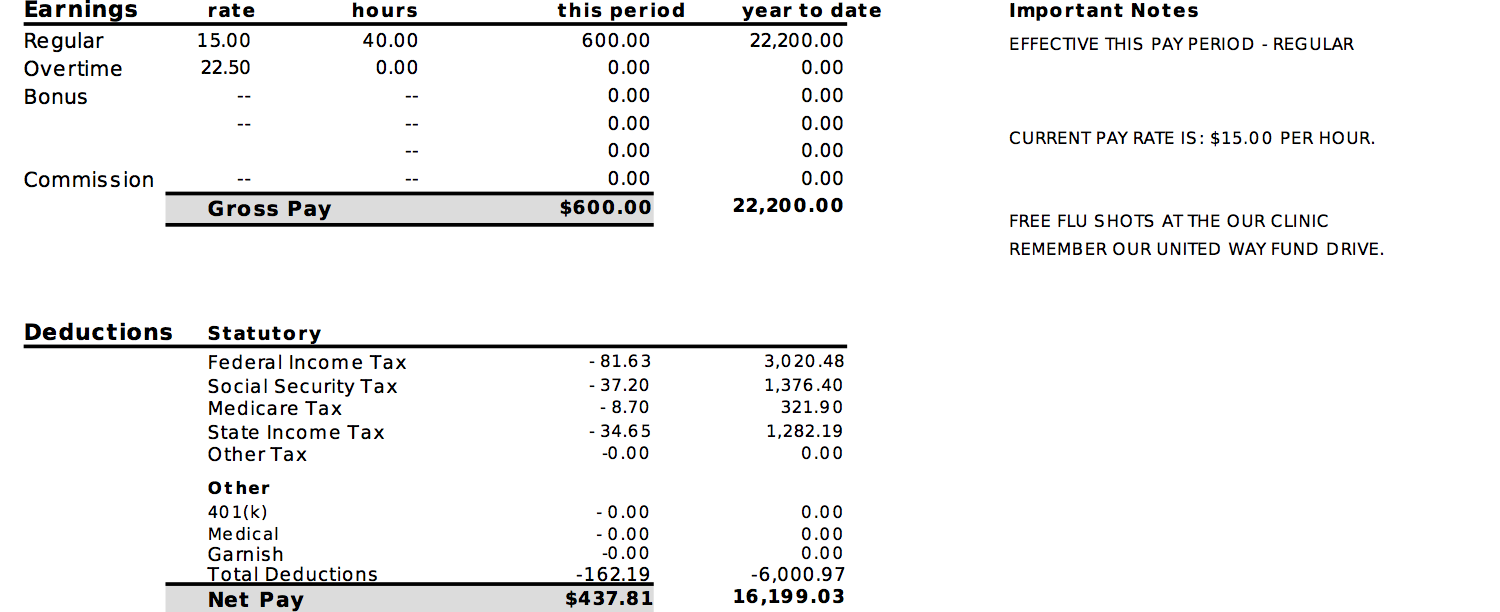

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

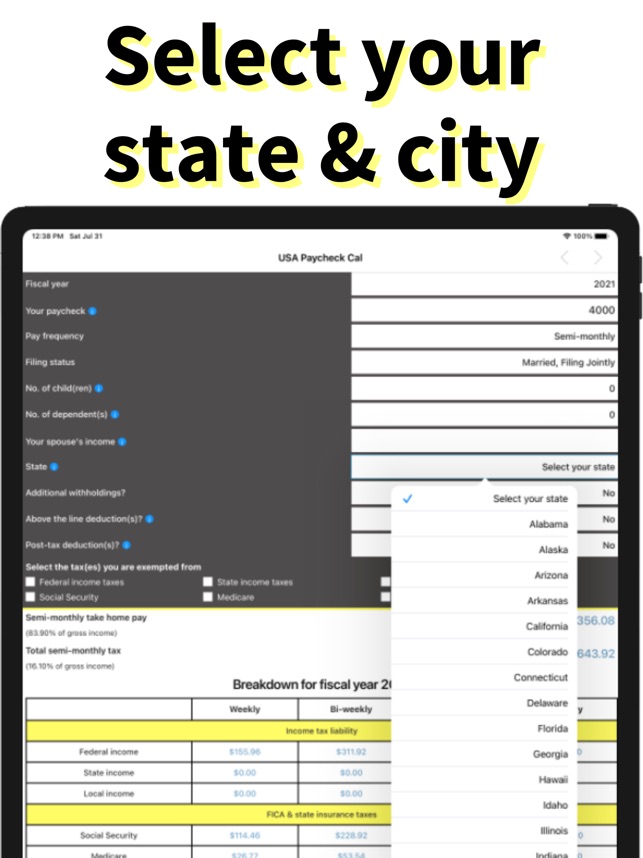

The average tax rate for taxpayers who earn over 1000000 is 331 percent. After a few seconds you will be provided with a full breakdown of the. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022. Total income taxes paid. Your average tax rate is.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. That means that your net pay will be 43041 per year or 3587 per month. Global salary benchmark and benefit data.

Just enter the wages tax withholdings and other information required. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. If youre a new employer your rate is 353.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. You may pay up to 050 less an hour for your new hires in their first 90 days of employment.

Your employer will withhold money from each of. You can even use historical tax years to figure out your total salary. Amount taken out of an average biweekly paycheck.

Estates over that amount must file an Illinois. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Make sure you are locally compliant with Papaya Global help.

Calculating paychecks and need some help. For those who make between 10000 and 20000 the average total tax rate is 04 percent.

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Sales Tax Rate Rates Calculator Avalara

Salary Paycheck Calculator Calculate Net Income Adp

What Taxes Are Taken Out Of A Paycheck In Illinois

Pay Stub Requirements By State Overview Chart Infographic

Paycheck Taxes Federal State Local Withholding H R Block

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Llc Tax Calculator Definitive Small Business Tax Estimator

Paycheck Calculator Free Payroll Tax Calculator Online Payroll Software

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Income Tax Calculator Smartasset

Usa Paycheck Calculator On The App Store

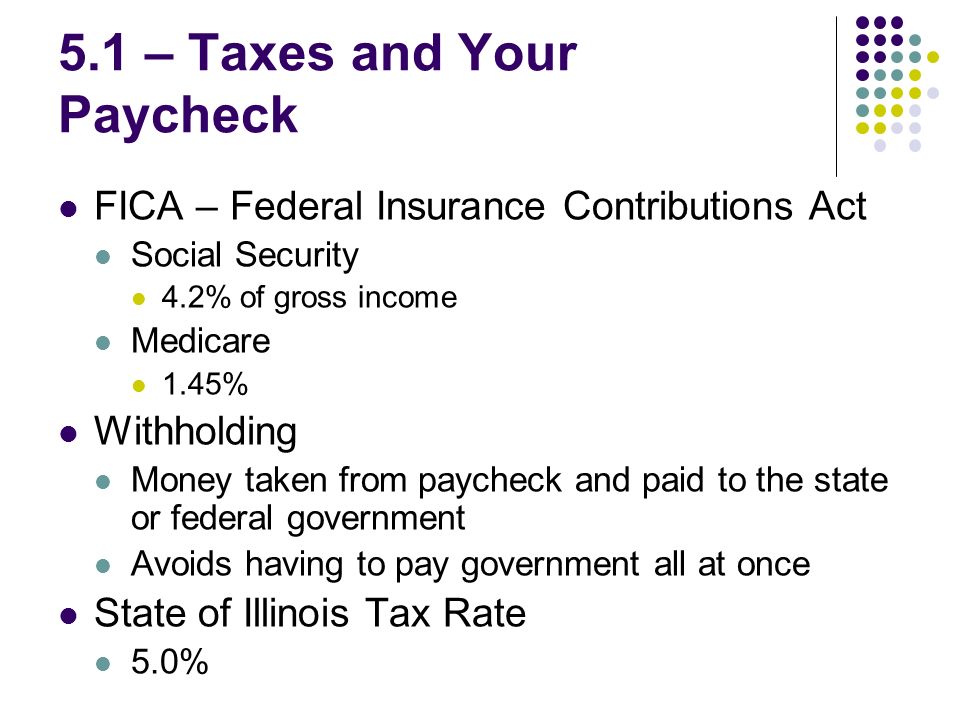

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Millions Of Americans Could Be Stunned As Their Tax Refunds Shrink The Washington Post